Every spring, the University of Southern California bestows an honor, which is “the highest award that the University…confers” upon a small number of distinguished individuals in the form of an honorary degree. Past recipients include notable names such as Neil Armstrong and John McCain. The panel in charge of reviewing nominations use a set criteria to evaluate all candidates. This criteria not only evaluates a nominee's success in his or her field, but also the impact this person has on their community or even the world. Seeing how the nominee is getting an honorary degree from USC, they must also abide by the Code of Ethics as well as follow the Role and Mission of USC.

in the form of an honorary degree. Past recipients include notable names such as Neil Armstrong and John McCain. The panel in charge of reviewing nominations use a set criteria to evaluate all candidates. This criteria not only evaluates a nominee's success in his or her field, but also the impact this person has on their community or even the world. Seeing how the nominee is getting an honorary degree from USC, they must also abide by the Code of Ethics as well as follow the Role and Mission of USC.

From this brief overview of an ideal candidate, one can assume that if a potential recipient were to meet these requirements, then he or she would be privileged enough to receive a degree. Surprisingly, there are two men in the business realm who have not received this honor. The first, Bill Gates, the richest man in the world, would be a clear choice for some because of his financial success. But, as James O. Freedman points out in Liberal Education and the Public Interest, “from time to time, controversies have erupted among faculty or students (sometimes both) on college campuses when the names of prospective honorary degree recipients have been made or become public"(125). Although this has not happened at USC, it is definitely something that could occur. Past panels might have taken this into account, especially when considering the controversy over the unfair business practices Bill Gates is accused of using to maintain and excel Microsoft’s power and success.

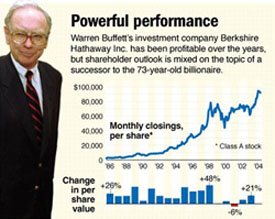

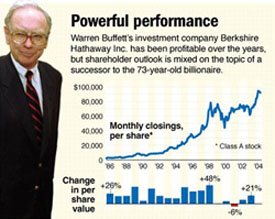

The second potential, and much stronger candidate that is prominent in the business world is Warren Buffet. Currently the CEO and largest shareholder of Berkshire Hathaway, Warren Buffet is the second richest man in the world according to Forbes magazine. He has attained what Mike W. Martin defines in Meaningful Work:Rethinking Professional Ethics as “the very definition of professions: advanced expertise, social recognition, and service to clients and community"(22). Not only is Buffet a savvy and successful businessman, he is a moral human being who is willing to give back to the society that gave him so much. Although one might have qualms in regard to Warren Buffet receiving an honorary degree to the University of Southern California, one must recognize that he is one of the most deserving candidates because of his embodiment of an ideal member of the Trojan family.

world is Warren Buffet. Currently the CEO and largest shareholder of Berkshire Hathaway, Warren Buffet is the second richest man in the world according to Forbes magazine. He has attained what Mike W. Martin defines in Meaningful Work:Rethinking Professional Ethics as “the very definition of professions: advanced expertise, social recognition, and service to clients and community"(22). Not only is Buffet a savvy and successful businessman, he is a moral human being who is willing to give back to the society that gave him so much. Although one might have qualms in regard to Warren Buffet receiving an honorary degree to the University of Southern California, one must recognize that he is one of the most deserving candidates because of his embodiment of an ideal member of the Trojan family.

An honorary degree is given to “honor individuals who have distinguished themselves through extraordinary achievements in scholarship, the professions, or other creative activities, whether or not they are widely known by the general public.” Warren Buffet distinguishes himself every day when he wakes up and Berkshire Hathaway, the company that he molded, is continuing to thrive. His approach to business most separates him from everyone else in the corporate world. Buffet’s strategy for Berkshire Hathaway was similar to that of his mentor Benjamin Graham, which was to buy companies “because they were cheap compared to their intrinsic value…as long as the market undervalued them relative to their intrinsic value he was making a solid investment.” Buffet also started to invest in potentially strong companies that had a strong competitive advantage. Companies, such as Coca-Cola and See's Candies, that produced niche products were less vulnerable to competitors taking over the market. He “has always been especially partial to companies that can sustain a competitive edge without tying up much capital…Buffet will not invest in a business unless he feels reasonably certain how much it will earn over the next 20 to 25 years.”

This strategy motivated him, at the age of thirty-five, to accumulate 49% of Berkshire Hathaway’s common stock and name himself director. With this new position, he was able to completely turn the company around to make it strong and successful. In case one can not fathom how successful and financially stable Berkshire Hathaway has become, “had you put $10,000 into Berkshire Hathaway when Buffet bought control in 1965, you’d have more than $50 million today, compared to the just under $500,000 you’d have if you’d invested in the Standard and Poor’s 500 stock index.” Warren Buffet is one of the main forces that brought about this success. Surprisingly, he does not continue working for the enormous amounts of wealth involved; he continues working because it is his creation which he will mold and perfect until he is satisfied. If wealth and fame was all he craved, he could have easily cashed out all of his stock options and retired without a care in the world. Instead, he is driven by what Martin describes as craft motives, which are “desires to achieve expertise and desires to manifest technical skill, theoretical understanding, and creativity"(22). His aspiration to achieve expertise is seen in the need to create the “perfect” company. To ensure that Berkshire Hathaway stays on top, Buffet keeps a close eye on the company’s balance sheet, especially when making a major decision. Because of this diligence, Berkshire has the “highest credit rating achievable and thus with the lowest cost of debt” which means “his company will not be one of those shaken by economic or natural catastrophes.”

Warren Buffet also deserves to be recognized for the personal achievement of remaining a humble individual. Seeing how he is the second richest man in the world, one might think that he is living “the  life”—but compared to other wealthy people, he is not. Minus the multi-million dollar corporate jet, which he named “The Indefensible” because of past remarks about CEO’s purchases, Buffet enjoys a very modest lifestyle. He still sleeps in “the same house in central Omaha he bought in 1958 for $31,500.” Even though he has so much money invested in the company, his annual salary is only $100,000. This is a perfect example of Warren Buffet holding to the same code of ethics that the USC family does. A line in the Code of Ethics reads, “We do not misappropriate the university’s resources, or resources belonging to others which are entrusted to our care.” He could easily make his salary the same as the average CEO in this country, which is around 9 million, but that would be mishandling the company’s resources. This humbleness does not pertain only to Berkshire Hathaway either; he has raised his children with these same ethics as well. When his daughter needed twenty dollars for parking, the only way he would give it to her is if she wrote him a check. Freedman, who was the president at Dartmouth, said by bestowing an honorary degree, “a university makes an explicit statement to its students and the world about the qualities of character and attainment it admires most"(117). Humbleness is definitely a quality that we, as a school, should admire the most.

life”—but compared to other wealthy people, he is not. Minus the multi-million dollar corporate jet, which he named “The Indefensible” because of past remarks about CEO’s purchases, Buffet enjoys a very modest lifestyle. He still sleeps in “the same house in central Omaha he bought in 1958 for $31,500.” Even though he has so much money invested in the company, his annual salary is only $100,000. This is a perfect example of Warren Buffet holding to the same code of ethics that the USC family does. A line in the Code of Ethics reads, “We do not misappropriate the university’s resources, or resources belonging to others which are entrusted to our care.” He could easily make his salary the same as the average CEO in this country, which is around 9 million, but that would be mishandling the company’s resources. This humbleness does not pertain only to Berkshire Hathaway either; he has raised his children with these same ethics as well. When his daughter needed twenty dollars for parking, the only way he would give it to her is if she wrote him a check. Freedman, who was the president at Dartmouth, said by bestowing an honorary degree, “a university makes an explicit statement to its students and the world about the qualities of character and attainment it admires most"(117). Humbleness is definitely a quality that we, as a school, should admire the most.

Another reason why an honorary degree is given is “to honor alumni and other individuals who have made outstanding contributions to the welfare and development of USC or the communities of which they are a part.” Warren Buffet has definitely achieved this within the Berkshire community. Donald and Mildred Othmer would agree that Buffet’s business genius greatly contributed to their welfare. The couple, Omaha natives, knew him when he had acquired Berkshire Hathaway. They each invested $25,000 into the company and when they passed in the late nineties, their combined net worth was around $750 million. This incident is not pertinent to only the Othmers; many people have become very wealthy as a result of investing in the company in which Buffet has devoted so much time and money in .

.

Throughout the years, while making great contributions to the welfare and development of the Berkshire community, Warren Buffet has also listened and paid attention to the shareholders, the community members, who he is working to please. The USC Code of Ethics states, “By respecting the rights and dignity of others, and by striving for fairness and honesty in our dealings with others, we create an ethical university of which we can all be proud, and which will serve as a bright beacon for all peoples in our day and in the centuries to come.” Buffet calls the shareholder meetings, “‘Woodstock for Capitalists.’ Investors have been known to purchase a single Berkshire share just for the opportunity to pick the master’s brain each spring. The most recent meeting was held in May. More than 14,000 people crowded into Omaha’s Aksarben…Coliseum for a six-hour question-and-answer session.” This initiative to keep in contact with the shareholders is important because even though they own a small percentage of Berkshire Hathaway, each member of the Berkshire community is allowed to get involved and feel significant by talking to the CEO and Vice Chairman about what it is they are doing and why they are doing it. Martin sums this up nicely with “we understand persons only when we grasp the value commitments embedded in their motives, character, and worldview"(16). By meeting with the shareholders, Warren Buffet is opening up and revealing his character and motives.

A common trend among many of the past recipients is their philanthropic nature. This makes sense considering USC gives honorary degrees “to recognize exceptional acts of philanthropy to the university and/or on the national or world scene.” What is “an exceptional act?” It is, among other things, devoting one’s life to help those less fortunate, starting a free clinic, or opening animal shelters  all over the country. But, what about this? Warren Buffet “pledged to gradually give 85% of his Berkshire stock to five foundations. A dominant five-sixths of the shares will go to the world’s largest philanthropic organization, the $30 billion Bill and Melinda Gates Foundation.” The Bill and Melinda Gates Foundation focuses on libraries, high schools, medical research, and global health—specifically malaria, HIV/AIDS, and tuberculosis. Buffet will be helping Bill and Melinda, the sole trustees, with the Foundation. He will also give $2.5 billion to the Susan Thompson Buffet Foundation, which focuses primarily on reproductive health, family planning, and pro-choice causes. USC’s Role and Mission Statement states, “USC provides public leadership and public service in such diverse fields as health care, economic development, social welfare, scientific research, public policy and the arts.” Although Warren Buffet’s fortune is not going to every single one of those fields, it is going to a majority of them. Exceptional act? Absolutely.

all over the country. But, what about this? Warren Buffet “pledged to gradually give 85% of his Berkshire stock to five foundations. A dominant five-sixths of the shares will go to the world’s largest philanthropic organization, the $30 billion Bill and Melinda Gates Foundation.” The Bill and Melinda Gates Foundation focuses on libraries, high schools, medical research, and global health—specifically malaria, HIV/AIDS, and tuberculosis. Buffet will be helping Bill and Melinda, the sole trustees, with the Foundation. He will also give $2.5 billion to the Susan Thompson Buffet Foundation, which focuses primarily on reproductive health, family planning, and pro-choice causes. USC’s Role and Mission Statement states, “USC provides public leadership and public service in such diverse fields as health care, economic development, social welfare, scientific research, public policy and the arts.” Although Warren Buffet’s fortune is not going to every single one of those fields, it is going to a majority of them. Exceptional act? Absolutely.

Those who would be against Warren Buffet receiving an honorary degree probably disagree with one, or even both, of the two main concerns in regards to Buffet’s investing strategy. The first concern is he only invests in the long term. He says “he won’t invest in a company unless he can ‘see’ it, unless he can imagine what its balance sheet might look like in a decade  or two” which is different considering today, “investors hold stocks for just days, or even minutes, at a time.” The second concern is the fact that he has avoided any investing in the internet industry, including the stock of one of his good friends, Bill Gates. In the 1990’s, even though Berkshire stock hit a high of $80,000 per share, the dot-com obsession started and he still “was accused of ‘losing his touch.’” So, one might argue that Warren Buffet does not deserve an honorary degree because he made a huge investing mistake by excluding short term investments and internet companies from his portfolio. Unfortunately, that argument does not hold up against “a man whose own holdings have outpaced the Dow Jones Industrial Average for more than 40 years.” As for investing in internet companies, “when the markets finally did come to their senses, Warren Buffet…was once again seen as an investment icon.”

or two” which is different considering today, “investors hold stocks for just days, or even minutes, at a time.” The second concern is the fact that he has avoided any investing in the internet industry, including the stock of one of his good friends, Bill Gates. In the 1990’s, even though Berkshire stock hit a high of $80,000 per share, the dot-com obsession started and he still “was accused of ‘losing his touch.’” So, one might argue that Warren Buffet does not deserve an honorary degree because he made a huge investing mistake by excluding short term investments and internet companies from his portfolio. Unfortunately, that argument does not hold up against “a man whose own holdings have outpaced the Dow Jones Industrial Average for more than 40 years.” As for investing in internet companies, “when the markets finally did come to their senses, Warren Buffet…was once again seen as an investment icon.”

If Warren Buffet were given the honor of delivering the commencement speech to the graduating students, the main message would be to find something that you really enjoy doing and go with it. Business, particularly entrepreneurial endeavors, have been an interest in Warren’s life ever since the age of eleven. That year, he made his first stock purchase, three shares of Cities Service Preferred. From an early age, it was apparent that Warren Buffet was going to go into business. The drive and motive to turn a smart profit can be seen in all of his projects so far in life.  Berkshire Hathaway would not be what it is today if he had not got the enjoyment out of work. He is a very passionate person when it comes to business because it is something that he has worked his whole life for. All USC students should find something that they will be that passionate about when they are in their late seventies. Being incredibly wealthy, but unhappy with one’s work is not a good way to live. If one sacrifices the financial rewards for happiness, the chances of success are much greater—even if the success is not in a monetary form. Although it might seem like he is a complete hypocrite for saying this, look at his lifestyle and passion for Berkshire Hathaway and one might notice that the financial return received from his work is not the main objective. Being a frugal and humble person, everything that he makes is saved for charity, which shows that he continues to work for enjoyment, not for wealth.

Berkshire Hathaway would not be what it is today if he had not got the enjoyment out of work. He is a very passionate person when it comes to business because it is something that he has worked his whole life for. All USC students should find something that they will be that passionate about when they are in their late seventies. Being incredibly wealthy, but unhappy with one’s work is not a good way to live. If one sacrifices the financial rewards for happiness, the chances of success are much greater—even if the success is not in a monetary form. Although it might seem like he is a complete hypocrite for saying this, look at his lifestyle and passion for Berkshire Hathaway and one might notice that the financial return received from his work is not the main objective. Being a frugal and humble person, everything that he makes is saved for charity, which shows that he continues to work for enjoyment, not for wealth.

Warren Buffet is more than qualified to receive an honorary degree from USC. In case the previous three criteria were not sufficiently met, he definitely satisfies the fourth: “to elevate the university in the eyes of the world by honoring individuals who are widely known and highly regarded for achievements in their respective fields of endeavor.” Warren Buffet, the second richest man in the world and one of the most respected investors ever, would certainly elevate the university’s reputation to the world if honored with a degree. Wealth does not even need to be a factor in proving his high esteem. One could reference his genius and very effective business strategy, business’ success, the respect that he shows the shareholders, “exceptional acts of philanthropy,” or his passion and joy for Berkshire Hathaway. Because of his outstanding public service to the world and the Berkshire community, Warren Buffet should receive a doctoral degree in the laws. As an institution responsible for shaping the minds of those who attend, USC not only needs to acknowledge success in a given field, but also reward those who give their time and resources to improve our world. James O. Freedman wrote, “In conferring honorary degrees, I hoped to persuade our students and commencement guests that each honorand’s character and attainment were worthy of emulation and admiration"(132). Even if one does not agree with some of the decisions he makes, who does not admire, or even thrive to emulate Warren Buffet's philanthropic and investing prowess?

in the form of an honorary degree. Past recipients include notable names such as Neil Armstrong and John McCain. The panel in charge of reviewing nominations use a set criteria to evaluate all candidates. This criteria not only evaluates a nominee's success in his or her field, but also the impact this person has on their community or even the world. Seeing how the nominee is getting an honorary degree from USC, they must also abide by the Code of Ethics as well as follow the Role and Mission of USC.

in the form of an honorary degree. Past recipients include notable names such as Neil Armstrong and John McCain. The panel in charge of reviewing nominations use a set criteria to evaluate all candidates. This criteria not only evaluates a nominee's success in his or her field, but also the impact this person has on their community or even the world. Seeing how the nominee is getting an honorary degree from USC, they must also abide by the Code of Ethics as well as follow the Role and Mission of USC. world is Warren Buffet. Currently the CEO and largest shareholder of

world is Warren Buffet. Currently the CEO and largest shareholder of  life”—but compared to other wealthy people, he is not. Minus the multi-million dollar corporate jet, which he named “The Indefensible” because of past remarks about CEO’s purchases, Buffet enjoys a very modest lifestyle. He still sleeps in “the same house in central Omaha he bought in 1958 for $31,500.” Even though he has so much money invested in the company, his annual salary is only $100,000. This is a perfect example of Warren Buffet holding to the same code of ethics that the USC family does. A line in the Code of Ethics reads, “We do not misappropriate the university’s resources, or resources belonging to others which are entrusted to our care.” He could easily make his salary the same as the average CEO in this country, which is around 9 million, but that would be mishandling the company’s resources. This humbleness does not pertain only to Berkshire Hathaway either; he has raised his children with these same ethics as well. When his daughter needed twenty dollars for parking, the only way he would give it to her is if she wrote him a check. Freedman, who was the president at

life”—but compared to other wealthy people, he is not. Minus the multi-million dollar corporate jet, which he named “The Indefensible” because of past remarks about CEO’s purchases, Buffet enjoys a very modest lifestyle. He still sleeps in “the same house in central Omaha he bought in 1958 for $31,500.” Even though he has so much money invested in the company, his annual salary is only $100,000. This is a perfect example of Warren Buffet holding to the same code of ethics that the USC family does. A line in the Code of Ethics reads, “We do not misappropriate the university’s resources, or resources belonging to others which are entrusted to our care.” He could easily make his salary the same as the average CEO in this country, which is around 9 million, but that would be mishandling the company’s resources. This humbleness does not pertain only to Berkshire Hathaway either; he has raised his children with these same ethics as well. When his daughter needed twenty dollars for parking, the only way he would give it to her is if she wrote him a check. Freedman, who was the president at  .

.  all over the country. But, what about this? Warren Buffet “pledged to gradually give 85% of his

all over the country. But, what about this? Warren Buffet “pledged to gradually give 85% of his  or two” which is different considering today, “investors hold stocks for just days, or even minutes, at a time.” The second concern is the fact that he has avoided any investing in the internet industry, including the stock of one of his good friends, Bill Gates. In the 1990’s, even though

or two” which is different considering today, “investors hold stocks for just days, or even minutes, at a time.” The second concern is the fact that he has avoided any investing in the internet industry, including the stock of one of his good friends, Bill Gates. In the 1990’s, even though  Berkshire Hathaway would not be what it is today if

Berkshire Hathaway would not be what it is today if

0 Comments:

Post a Comment

<< Home